promotions

What is Goodbudget?

Richard Howard • April 20, 2020

At Ting, we’re really big on budgeting and saving money. So just like you, we’re aware that it can be challenging to consistently get smart spending and saving right. That’s why we’re huge fans of Goodbudget. “What the heck is Goodbudget?” you’re probably wondering. We’ll do you one better than telling you about it, we’ll actually give you a quick review of the budget tool.

What is Goodbudget?

Goodbudget is a virtual budget planner designed to emulate the “envelope” system. Way back in the day (ask your grandparents), folks would budget by allocating funds to certain expenses and then placing them in labeled envelopes. For example, you might put $50 in your “groceries” envelope (hey, this is in your grandparents’ time), $100 dollars in the “bills” envelope and so on. Then, when you go to the store and spend $50 on groceries, you can rest assured knowing that your rent money is safely set aside in a different envelope. Since keeping a bunch of envelopes full of cash around your house is one step above putting money under the mattress, Goodbudget has come up with a virtual version of the technique.

How does it work?

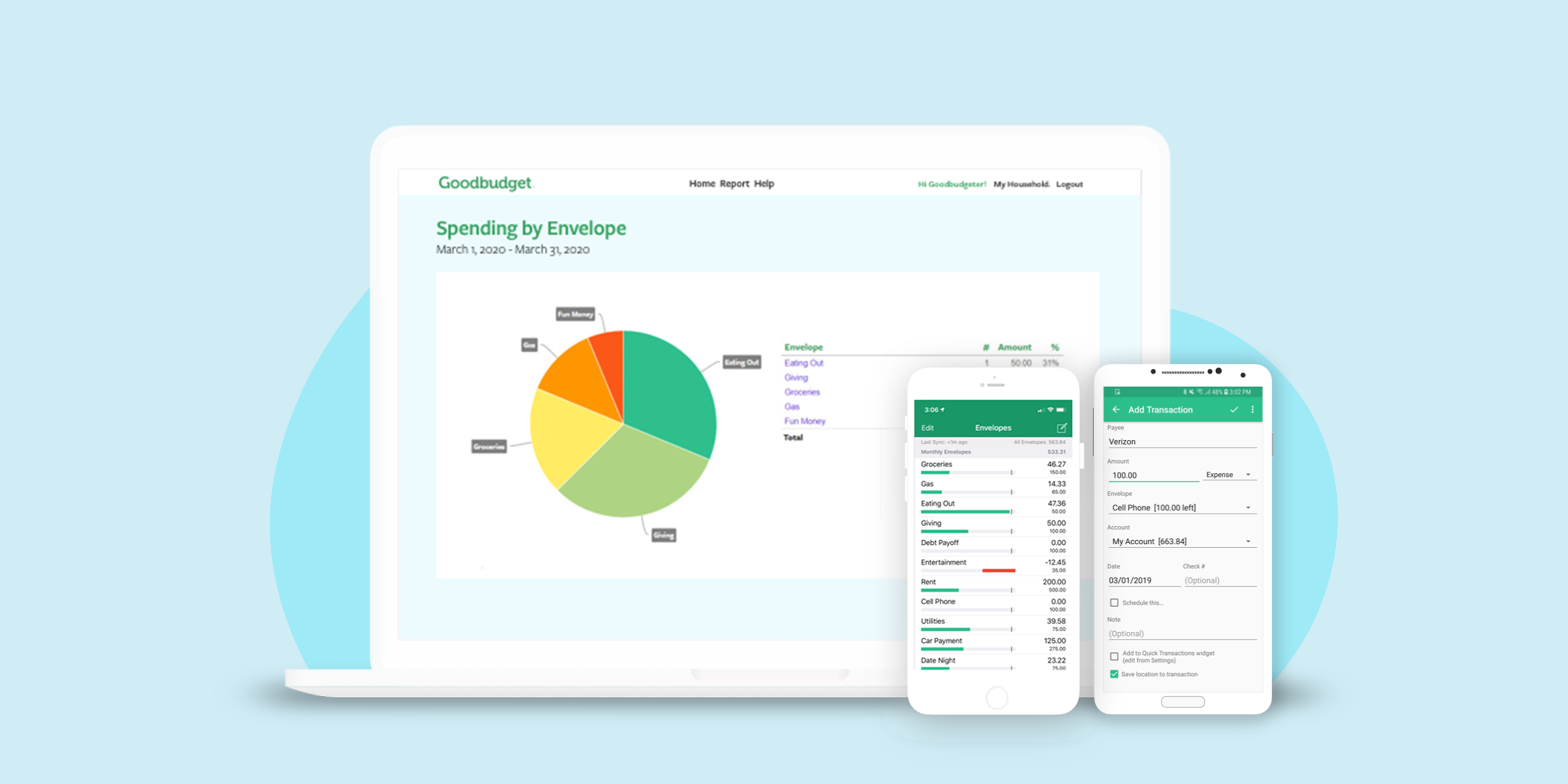

Goodbudget checks those two all-important boxes of “simple” and “effective.” Your virtual envelopes are separated into two types. “Regular” envelopes are for smaller, everyday expenses while “More” envelopes are for larger, often annual expenses (e.g. family vacation). You can also set up “Accounts” to track your real life balances and debts through the app.

With your Goodbudget household set up, you’ll then begin logging your transactions and Goodbudget will do the rest. Log a $60 visit to the grocery, and that amount will be subtracted from your “groceries” envelope. In addition to being shown numerically, your envelopes’ statuses are shown in bar chart form for easy tracking. If you see red, you know that you’ve gone over budget. You can also get insight into your financial habits thanks to the included graphs and charts.

While you can’t integrate bank accounts to update transactions in real-time, you can import your statements in standard formats like Quicken or .CSV then attribute transactions to the corresponding envelope.

Verdict

We think Goodbudget is the perfect budget tool to help financially conscious individuals make realistic budgets and stick to them. While there is a free version available, we found Goodbudget Plus to be the better option due to an ability to add an unlimited number of envelopes and financial accounts, keep a seven-year history and connect to more of your devices. They understand that paying a large sum for a budgeting app would be counterproductive, so they charge just $7 a month or $60 annually which translates to a paltry $5 a month.